Hereafter an analysis of prospects for the foreign trade of the Republic of Belarus and its consecutive dependencies will be provided.

Despite the obvious Moscow-wards lean of the ruling Lukashenka regime, throughout its existence the formula for foreign trade had been about diversification – minimisation of falling into full dependance of one dominating trading partner. For over two and half decades it was possible to maintain this balance.

The breach started following the events of 2020 and subsequent economic sanctions over Belarus, and deteriorated after Belarus’s co-participating in the Russian full-scale aggression against Ukraine in 2022. The unprecedented sanctions posed in reaction to the latter pushed Belarus into the embrace of Russia.

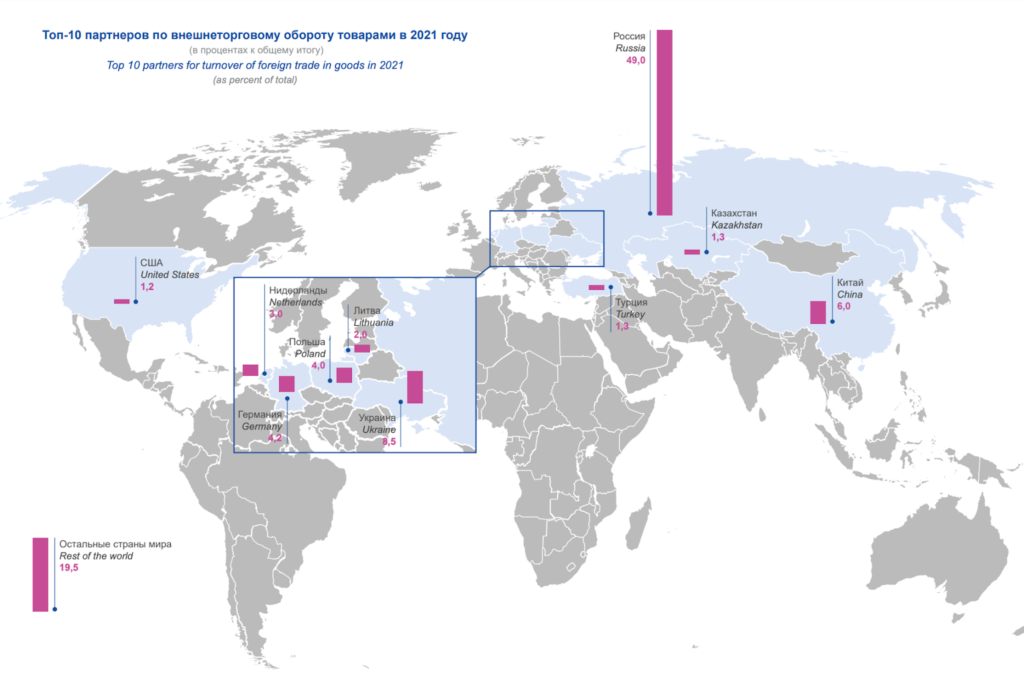

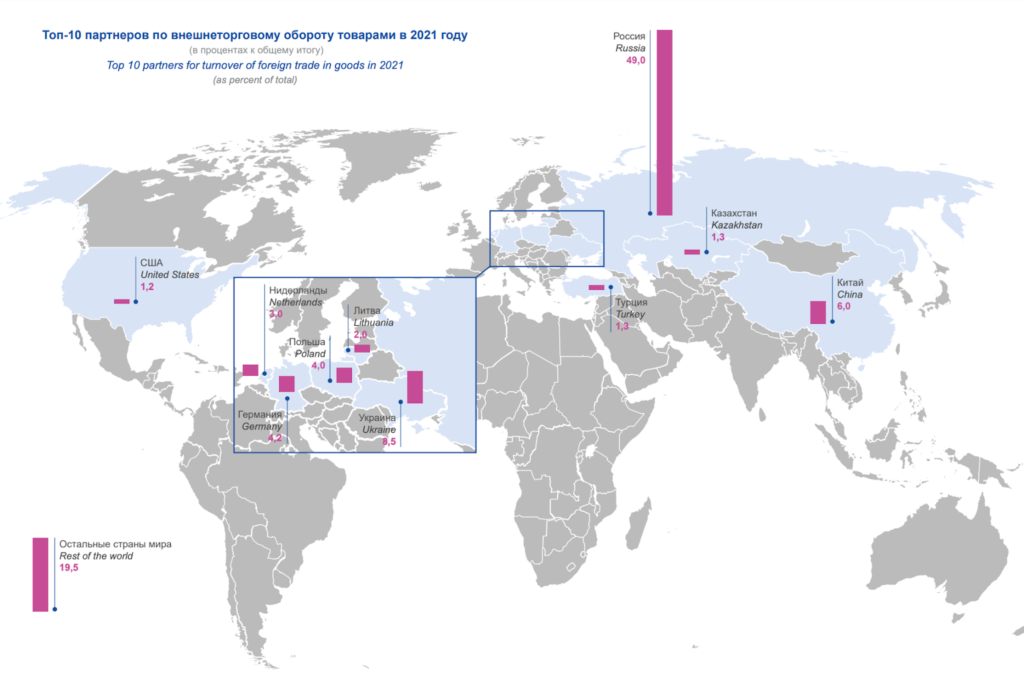

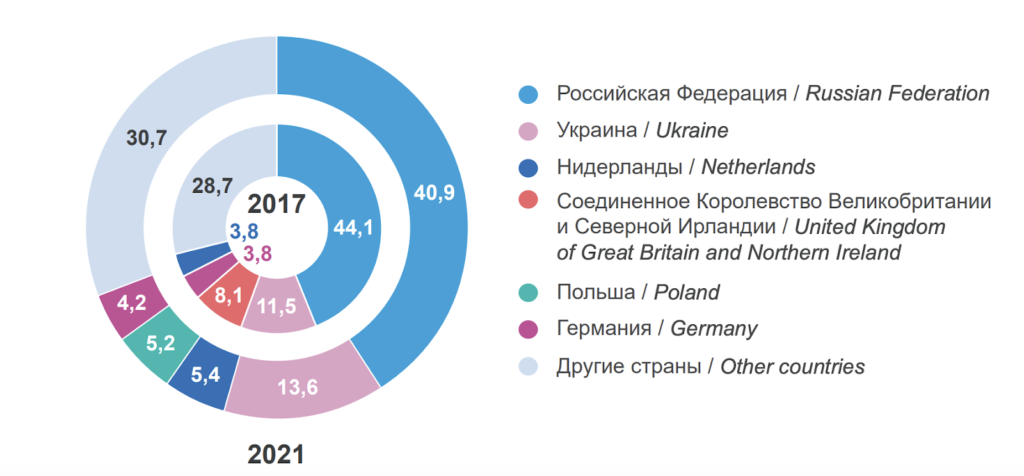

The foreign trading indicators of the pre-war (yet 2020-affected) Belarus demonstrate Russia being the top-1 partner in terms of exports, imports and turnover. What’s noticeable, the second place in turnover was held by Ukraine, the third being China. The rest in the top-10 trading partners were dominated by the Western countries while the European Union countries combined make the EU Belarus’s top-2 trading partner.

Belarus’s top 10 partners for turnover of foreign trade in goods in 2021 (as percent of total)

Belarus’s commodity exports by major trading partner countries (as percent of total exports)

Belarus’s commodity imports by major trading partner countries (as percent of total imports)

The sanctions of 2022 banned crucial Belarusian exports of fertilisers, timber, agriproducts, iron and steel products to the EU, as well as banned a row of positions for importing to Belarus. Trade with Ukraine has logically faced a dramatic decline. Thus, the Russian Federation remains not only the largest partner, largest market, but a barely substitutable one. Which buries the former aspirations for diversification.

It’s important to point out that the Belarusian economy is hugely dependent on Russian loans which also complicates any manoeuvres away from the Russian orbit. In 2022, Belarus refused to repay the Western loans in foreign currencies, doing so in Belarusian rubel, which virtually means a technical default and further inaccessibility of those loans and sources for modernisation of economy.

Hand-in-hand with the sanctions against Russia – predominantly ban of imports of high technologies – Belarus takes its opportunity to supply its largest market with those. Unfortunately, the drastic brain drain (vast reduction of the IT sector, also due to repression over its representatives) and the poor level of the technologies does not make this branch the new crock of gold.

Speaking of trends in Belarus, through comparison of 2021 and 2022, the GDP is decreasing (-7% to the previous year), inflation is increasing (over 12% according only to the state reports), real income of the population is declining (-5% to the previous year).

However, a new trend is pronounced by the ruling regime — “rerouting from the West to the East”. Lukashenka is betting on China as a counterweight to Russia. He utilises the special relations with Beijing – the “all-weather comprehensive strategic partnership of the Republic of Belarus and PRC”. Regrettably, China is interested primarily in exporting to Belarus, not importing from.

In the present situation much depends on Belarus’s degree of participation in the Russian-Ukrainian war. The sanctions against Belarus for its co-participating in the aggression may take the same severity as those against Russia in case of the Belarusian army entering the war on Russia’s side. In this case the two pariah states would be cursed to be tied even much closer, essentially including economic affairs.

Jan Mačulski